Rupee drops 24 paise to 55.58 on dollar demand

| You Enjoyed This Post Please Take 5 Seconds To Share It. |

Housefull 3 Movie Review And Rating : Housefull 3 is a hindi movie starring by akshay kumar, The bollywood box office is gearing up for its one biggest film to be witnessed tomorrow. The biggest box office marathon do happen every week and in the process there is one more film that is releasing t

We often try to relate our real life to what we see in movies. But this is absolutely insane given that mos More...

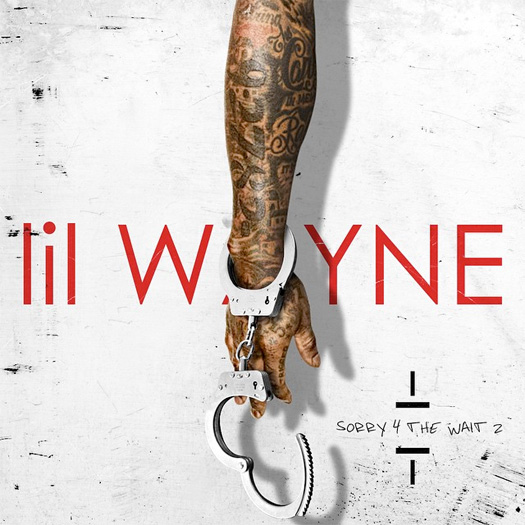

We saw the official artwork earlier, now Lil Wayne reveals the tracklisting for his forthcoming mixt More...

Aamir Khan and Rajkumar Hirnai seem to have worked their magic once again at the box office. According More...

Image Source Odisha Police has introduced a machine in Bhubaneshwar that is being seen as a major step t...

The Rohtak girls who garnered the limelight last year after the release of a video of them thrashing their ...

Many people believe that: 1) It takes money to make money 2) You need to work hard for wealth 3) You...

Do you know that you can't sit and wait for your site to make money for you? Yes, you need to market yo...

From time immemorial a woman's virginity has been her prized possession. Throughout history one will r...

Dr Suman Bijlani lists women's common sexual concerns and what they mean for men... Wonder why your...

'Porn' makes men hopeless in bed

'Porn' makes men hopeless in bedIt's a known fact that most men watch porn. But are you one of those guys who regularly get their dose ...

With just two weeks to go, start indulging in proper skin and hair care to look your best on Valentine'...

A dastardly pirate steals a hamburger recipe from the bottom of the sea and it's up to a sponge, a star...

Martin Scorsese's "The Wolf of Wall Street" and Disney's animated fantasy hit "Froz...

Shirley Temple Black, who as a dimpled, precocious and determined little girl in the 1930s sang and tap-dan...

No wonder Indian film industry has ruled millions of hearts worldwide. But being just another fan of Bollyw...

Amitabh Bachchan, Dhanush, Akshara Haasan Shamitabh has a doubly dramatic act - but less emotion Sto...

If the grapevine is to be believed Kareena Kapoor is planning to dole out dates for 'Dedh Ishqiya' ...

One of the most common questions being asked in recent weeks almost continuously is who is this female Chel...

The Android versus iOS rivalry has been ongoing for nearly 10 years. As of Q3 2014, Android owned more tha...

No wonder Indian film industry has ruled millions of hearts worldwide. But being just another fan of Bollyw More...

Shoghi is situated in shimla in the state Himachal Pradesh in India. It is an outskirt of shimla. It is o More...

Image Source Odisha Police has introduced a machine in Bhubaneshwar that is being seen as a major step t More...